accumulated earnings tax calculation

REASONABLE NEEDS OF THE BUSINESS. Tax-exempt interest income is not part of the accumulated earnings tax base but it is considered in determining whether the corporation has retained excess earnings.

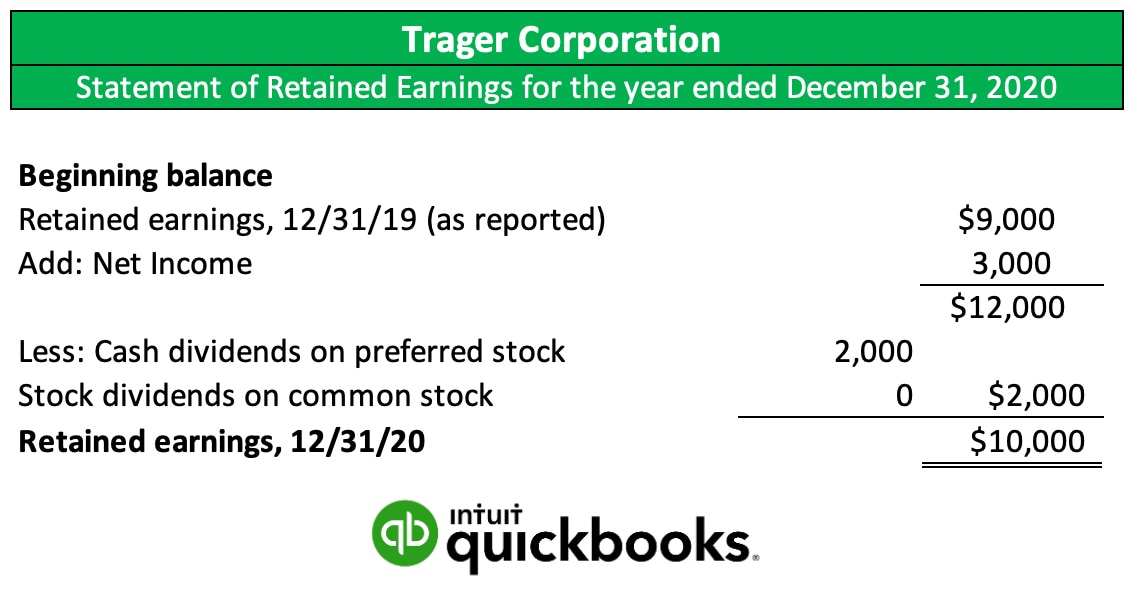

Retained Earnings Formula Definition Examples Calculations

Ad Ensure Accuracy Prove Compliance Prepare Quick Easy-To-Understand Financial Reports.

. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons. Keep in mind that this is not a self-imposed tax. The Accumulated Earnings Tax IRC.

The regular corporate income tax. The accumulated earnings tax is equal to 20 of the accumulated taxable income and is imposed in addition to other taxes required under the Internal Revenue Code. Section 531 for being profitable and not paying a sufficient level of dividends.

The tax is in addition to the regular corporate income tax and is assessed by the IRS typically during an IRS audit. IRM 48821 Accumulated Earnings Tax. There is no IRS form for reporting the AET.

However since the amount by which 150000 exceeds the accumulated earnings and profits at the close of the preceding taxable year is more than 20000 the minimum accumulated earnings. The remaining 283000 distribution amount will be absorbed by the accumulated EP balance of. C corporations can earn up to 250000 without incurring accumulated earning tax.

Let Us Do the Legwork. The formula for calculating the working capital needs of a manufacturing concern or similar business is set forth in the Bardahl Manufacturing Corp. Easily Approve Automated Matching Suggestions or Make Changes and Additions.

Calculating the Accumulated Earnings Tax. The formula for calculating retained earnings RE is. The tax is assessed at the highest individual tax rate on the corporations accumulated income and is in addition to the regular corporate income tax.

531 and 532. The Accumulated Earnings Tax is computed by multiplying the Accumulated Taxable Income IRC. The Accumulated Earnings Tax is more like a penalty since it is assessed by the IRS often years after the income tax return was filed.

When the PHC tax applies there is relief from the accumulated earnings tax Section 532a b1. Ad Contact 100s of Local Tax Accountants Free Today. The company made 700000 in net profits and paid dividends worth 300000 in the same year.

The accumulated earnings tax AET is a penalty tax imposed on corporations for unreasonably accumulating earnings in the corporation. In that case the Tax Court permitted the corporation to accumulate enough working capital to cover the normal. This tax evolved as shareholders began electing to have companies retain earnings rather than pay them out as dividends in an effort to avoid.

The tax rate is 20 of accumulated taxable in-come defined as taxable income with adjustments including the subtraction of federal and foreign income taxes. The PHC tax is self-imposed. A corporation may be allowed an accumulated earnings credit in the na-ture of a deduction in computing accu-mulated taxable income to the.

The accumulated earnings credit allowable under section 535 c 1 on the basis of the reasonable needs of the business is determined to be only 20000. It compensates for taxes which cannot be levied on dividends. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends with the purpose of avoiding shareholder - level tax seeSec.

RE Initial RE net income dividends. A Personal Services Company PSC can make profits of up to 150000 without having to pay these fees. If imposed the earnings are subject to triple taxation when eventually.

The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Accumulated earnings and profits are a companys net profits after paying dividends to.

The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company. Shareholder Calculation of Global. The tax is assessed by the IRS rather than self-assessed.

Given the reasonable needs of the business part of the tax calculation put ten around a table to. Calculating the Accumulated Earnings. However if a corporation allows earnings to accumulate beyond the reasonable needs of the business it may be subject to an accumulated earnings tax of 20.

In periods where corporate tax rates were significantly lower than individual tax rates an obvious. A 400000 distribution in year 6 will be sourced first from the current-year EP as shown in Exhibit 3. For example lets assume a certain company has 100000 in accumulated earnings at the beginning of the year.

Calculation of Accumulated Earnings. The purpose of the accumulated. Discover Helpful Information And Resources On Taxes From AARP.

Of the 400000 distribution the current-year EP will cover the first 117000. An IRS review of a business can impose it. Since the accumulated earnings tax is 20 of the accumulated earnings tax base it is 1 st necessary to determine that amount.

The accumulated earnings tax is imposed on the accumulated taxable income of every corporation formed or availed of for the purpose of avoiding the income tax with respect to its shareholders by permitting earnings and profits to accumulate instead of being divided or distributed. Accumulated earnings and profits E P is an accounting term applicable to stockholders of corporations. It is presumed that a corporation can retain up to 25000000 or 15000000 for certain service corporations for.

Earnings And Profits Computation Case Study

Demystifying Irc Section 965 Math The Cpa Journal

Demystifying Irc Section 965 Math The Cpa Journal

Retained Earnings Formula And Calculator Excel Template

Demystifying Irc Section 965 Math The Cpa Journal

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

Earnings And Profits Computation Case Study

Retained Earnings Formula And Calculator Excel Template

What Are Earnings After Tax Bdc Ca

:max_bytes(150000):strip_icc()/BOA-f8957c5ee9c14788b59a7e5edd802a7b.jpg)

Which Transactions Affect Retained Earnings

Demystifying Irc Section 965 Math The Cpa Journal

Demystifying Irc Section 965 Math The Cpa Journal

What Are Retained Earnings Quickbooks Australia

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

What Are Retained Earnings Quickbooks Canada

What Are Retained Earnings Bdc Ca